The State of Commercial Real Estate in Canada

From a transactional standpoint, particularly for investments, it was one of the slowest years we’ve had in a long time. Inflation and subsequent interest rate increases prompted a sense of uncertainty across global real estate markets. Canadians spent most of the year asking whether interest rates would keep rising, and wondering what the effects of these elevated rates would be.

The past 18 months have witnessed the impact of these rises, sending ripples through the commercial real estate (CRE) cap rate landscape—intricately influencing property valuation processes, dampening transactional activities, and curbing landowners’ enthusiasm for acquiring new properties or initiating fresh developments. As real estate inherently operates in cycles, we find ourselves navigating a transitional period, adapting to the enduring presence of elevated interest rates as we turn the page to 2024.

A recession’s impact on the national market

Statistics Canada reported that the national economy shrank in the third quarter by 0.3 per cent. The data agency’s preceding report showed a slight retraction in the previous quarter too, but those figures have since been updated to show 0.3 per cent growth last spring. Whether we’re on the verge of a recession or in the thick of it, there are some things to consider.

In times like these, occupiers usually pull back on expansion plans, which will continue to drive up vacancies. We’ve been seeing this trend already, particularly in the technology sector.

A recession may also start to shift the balance of power back towards employers as workers face more competition in a labour market that’s shedding jobs. Research has shown that managers are more interested in increasing in-office occupancy than their workers, so with more decision-making confidence, we could see higher office use, which could counteract the effects of some companies wishing to reduce their footprints.

The biggest potential impact of a recession would be a reduction in interest rates. Economists from Benjamin Tal to David Rosenberg have predicted a significant reduction in rates over the next two years. Lower rates would reactivate the investment and lending markets, helping offset some of the expected increases in cap rates. When, and how fast that happens is up for debate.

Managing distress

Higher debt loads, interest rates and a lack of liquidity mean Canada will experience distress. While some companies will be challenged, deals will accelerate as organizations rebalance their portfolios and find strategic ways to weather the storm. We’ll witness companies fade, startups emerge and consolidation occur in both the private and public real estate markets. Promisingly, innovation and movement are a byproduct of hard times and a healthy and essential step in restarting the next cycle.

Reconfiguring the office market

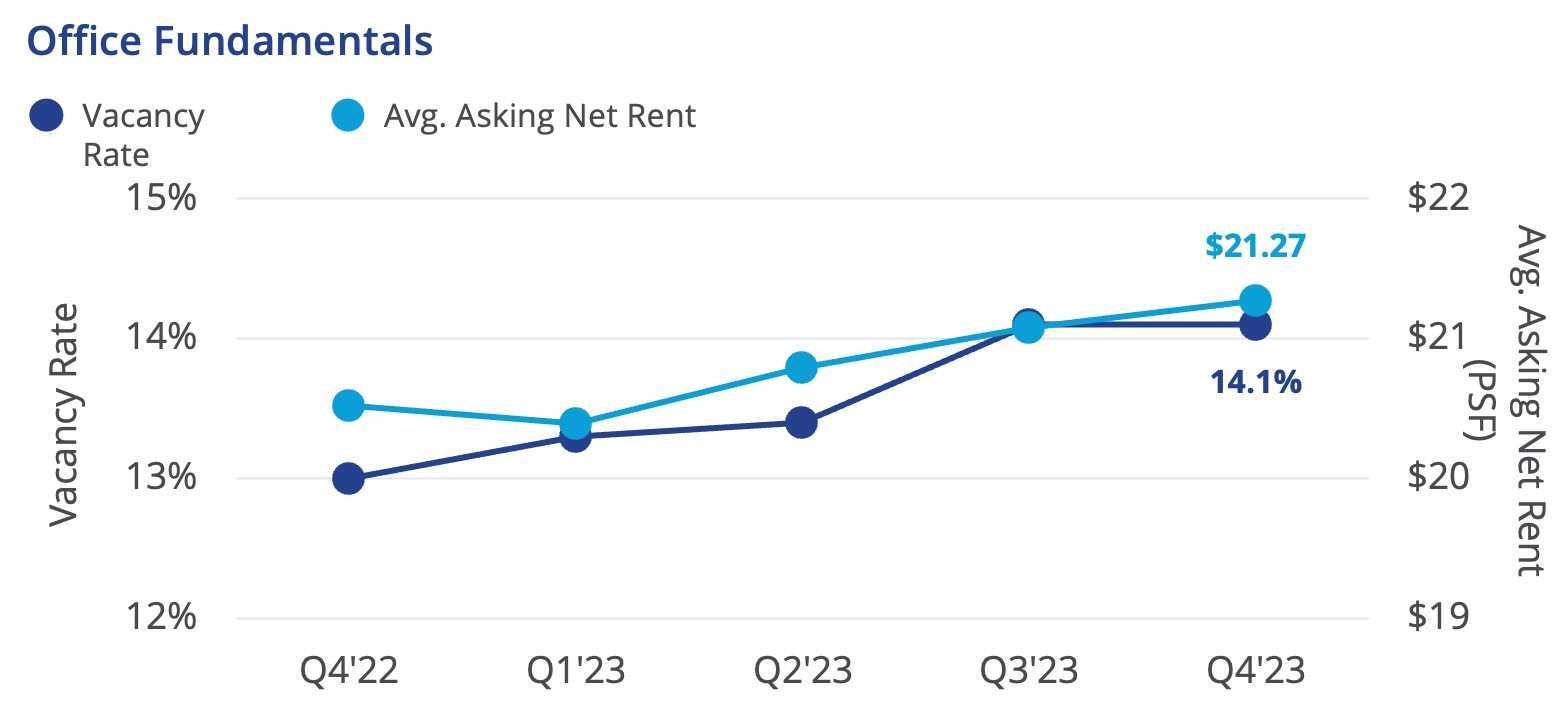

By the final quarter of 2023, national office vacancy, including downtown and suburban markets, had flattened to 14.1%, according to Colliers’ National Market Snapshot Q4. Office vacancy has been climbing over the last three years and will likely continue to rise at a decelerated rate in the short term.

Hybrid work has taken hold in Canada, but hybrid working does not mean 100% remote. Companies are clarifying their in-office work policies and we’ve learned that a combination of mandated in-office days, availability of diverse workspaces, and strategies that help to reduce commute times and costs all help contribute to more in-office time. Daily occupancy is still below 2019 levels, but signs are pointing to a gradual increase over time.

The shifting office conditions also provide rare opportunities for tenants. Prior to the pandemic, the low vacancy levels shut many companies out of the market for prime downtown offices, restricting them to lower-quality buildings. Now, companies have the ability to relocate, expand or establish a presence in downtown office space at more competitive lease rates or with favourable incentives.

We are seeing a flight to quality and a push towards bolstering amenities within buildings and the surrounding ecosystems. “Earning the commute” is increasingly important in traffic-heavy cities like Toronto, and creating a bustling downtown ecosystem is a key tool to create incentives to come to the office. For example, in Vancouver, downtown office vacancy reduced slightly to 11.8% at the end of 2023 with most absorption taking place towards the end of the year.

Generating confidence

In times of uncertainty, clients turn to their real estate service providers as advocates to help guide them with routes to recovery. At Colliers, we like to say that “experts choose experts.” Through various business streams including design, development advisory, placemaking, property and project management, appraisal, capital markets and leasing, we believe in being enterprising to help our clients both remain nimble and achieve long-term success.

Colliers, which has its origins in Vancouver, just marked its 125th anniversary. Over the decades, we’ve faced many challenges including both World Wars, pandemics, the Depression and recessions — and we’ve supported clients through the low points while generating value, sometimes in unexpected ways and places.

Improving diversity

It’s essential for the CRE industry to accelerate the pace of diversifying its workforce. We’ve improved this more in the last 15 years than in the previous 40 years, but more work must be done to evolve our talent rosters to welcome more talent from marginalized communities. Canada is a country built on diversity, and accessing all the talent, perspectives and experiences will strengthen our business and better enable us to help clients.

The first step to progress on this front is measuring demographics as an organization because if you can’t identify your shortcomings, you can’t enable change. This must be followed up with a commitment to focus less on hiring, and more on recruiting. Our industry must broaden our recruiting base into different schools, communities, organizations, cultures and industries. Deepening and diversifying our talent pool will be crucial to meet the challenges of what lies ahead.

Keeping things in perspective

As we exit a year underscored by uncertainty and prepare to face the challenges of a probable recession, distress and a shifting office market, it’s important to recognize this as part of a familiar cycle. There is plenty of work to do, but Canadian commercial real estate continues to have a strong, long-term outlook supported by positive macro trends, like large immigration targets, a consistent labour market, a stable government and a track record of GDP growth.

As the near-term outlook comes into focus, we are well-positioned for a return to strength as we leave the lingering feeling of uncertainty behind.